- Luci Money Moves

- Posts

- Remember That Friend Who Never Paid You Back? — Crack The Shared-Cost Code 🤝

Remember That Friend Who Never Paid You Back? — Crack The Shared-Cost Code 🤝

How to split group costs without anxiety, the awkwardness, or the eternal “you owe me” tombstone.

Hey there!

Remember that time you generously covered the Airbnb for the whole squad? You felt like a hero… for about five minutes. Then came the radio silence. The vague “I’ll get you later!” texts. Suddenly, you’re not a friend on vacation; you’re a detective chasing down ghosted IOUs, and it’s the worst side-quest ever.

We’ve all been in the “ghosted IOU” pain zone: group trips, dinners, concert tickets, even shared groceries. It’s emotionally exhausting.

But what if you had a blueprint? A shared-cost code, so you’re never left playing bounty hunter for your own money. Let’s build it.

Find What Your Looking For Here

Wait… Am I Just Being Cheap? 🤔

Let’s get this out of the way right now: There’s a huge difference between being financially smart and being cheap. This entire guide is about the former.

The “Codex” is for HIGH-STAKES spending:

|

This is NOT about:

That $6 coffee ☕️

Grabbing your friend a $12 lunch 🥪

Splitting a single Uber ride 🚕

Here’s the rule of thumb: For these small things, the expectation to pay you back is still there—it just shouldn’t require a formal treaty. A casual “You can Venmo me later!” or “I’ve got this round, you can get the next one!” is all you need.

If you find yourself needing to set ground rules for a single latte that’s your sign that either:

Your finances are too tight to be fronting anything right now, or

This friendship might have bigger trust issues than a coffee can solve

Being the “it’s on me” friend is a wonderful luxury, but it’s not something you can afford if you’re drowning in credit card debt. Financial self-awareness isn’t cheap—it’s badass.

The “Pre-Game” Pep Talk: Setting the Vibe ✌️

Now that we’ve cleared that up, let’s reframe the conversation. Talking money beforehand about big expenses isn’t being cheap; it’s an act of care, fairness, and mutual respect. It protects the relationship you have with your friend, partner, family, etc.

Don’t be this guy.

Timing & Tone

For big things, don’t bring it up as the bill hits the table. Pick a calm, neutral moment. “Hey, before we book the trip, can we do a quick 5-minute chat on how we’ll handle costs?” Make it a “finance date”—coffee is highly recommended.

Pro Tip: If you’re booking something like an Airbnb where a single payment is easiest, get everyone to send you their share before you hit “confirm.”

This simple step prevents a world of potential hassle.

The Agenda

What kinds of costs will come up? (Lodging, transport, shared meals, fun supplies?). Get it all out in the open.

Language Tip

Use “we” and “our” phrasing. “How should we split the groceries?” feels like a team mission. “You owe me for your share” feels like an accusation. This can also clear up any misconceptions on what’s “we” and what isn’t, because nobody wants to be stuck paying for something they thought was for everybody in the party when the other assumed it was just for you.

Lay The Foundation: Clear Agreements (Before $ Moves) 🏗️

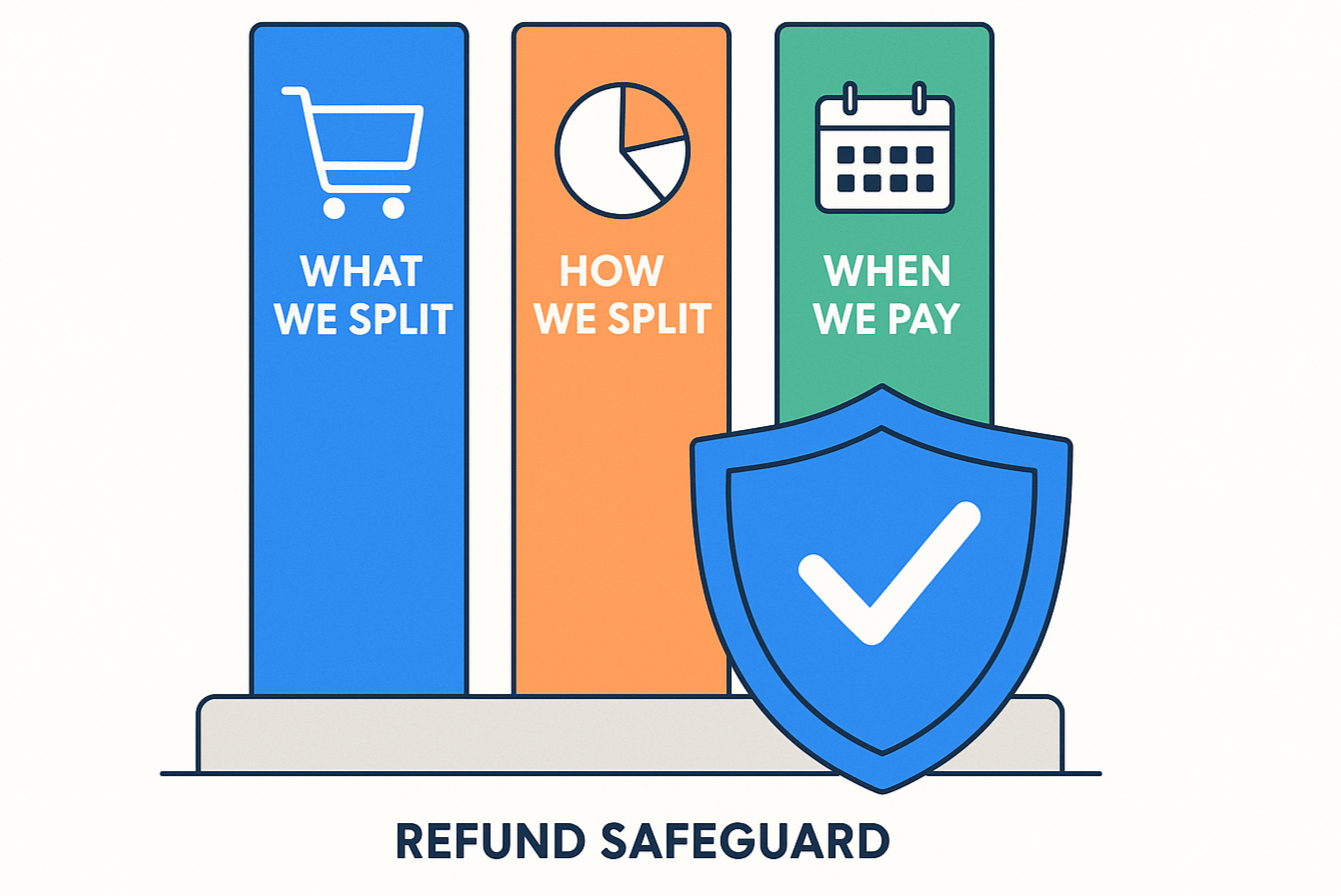

This is the crucial part for those big-ticket items. Get these three things straight before anyone swipes a card.

1️⃣ Scope: What’s In, What’s Out?

The “Ours” Pile: Lodging, group transport, shared meals, party supplies (drinks, snacks), recurring bills (WiFi, streaming).

The “Mine” Pile: Solo souvenir shopping, your personal latte, your extra cocktail.

The “Gray Area” (The Fuzzy Zone): That fancy cheese board, the bottle of wine for the table. The rule? Don’t Assume. A simple “Are we splitting this?” before you buy saves a world of resentment.

2️⃣ How to Split: Equal, Proportional, or Hybrid?

Equal Split: Easiest for shared essentials like a vacation rental.

Proportional: If someone has a much smaller room or a tighter budget.

Hybrid: Essentials split equally, extras only among those who partake.

| 3️⃣ The “Refund Safeguard” Clause 🔒 This is your golden rule for big expenses. Agree on it upfront: “If I front something for the group, everyone will Venmo/Zelle their share within 24-48 hours.” |

Why Asking For Money Back Feels So Dang Weird 🧠

Ever notice that the person who fronted the money suddenly feels like a bounty hunter?

There’s a science to this awkwardness.

The Mindset Gap: The lender is in “exchange mode” (I gave, I need back), while the borrower is often in “communal mode” (we’re friends, it’ll all work out).

The Judgement Trap: Studies show that even after you’re repaid, you can still feel resentment if you think the borrower used your money for something frivolous. That judgement lingers!

The Reciprocity Mismatch: Social psychology says we’re wired to reciprocate generosity. When someone doesn’t, it feels like a violation of an unspoken rule.

Knowing this isn’t just in your head makes it easier to create systems that bypass the emotional weirdness entirely.

Spotting A Potential “Ghoster” (Before You Front $500) 🚩

Protect your peace and your wallet. Warning signs include:

Consistent delays in repaying small amounts.

The classic excuses: “I forgot,” “I’ll get you tomorrow.”

Avoiding or getting defensive about money talk.

A history of happily accepting freebies without reciprocating.

Your Strategy: Use the “Refund Safeguard” clause. For people with multiple red flags, front less money. Do a “test run” with a small group cost before you front for a big trip.

💰 The Collection Phase: How to Nudge Without the Drama ✉️

The deadline has passed. Now what? Use tech to do the heavy lifting before you ever have to send a “friendly” text.

Let the App Do the Talking

Stop playing collection agency. Sometimes the only thing that breaks through the digital haze is a direct notification. Here are your new best friends for making “you owe me” a thing of the past:Splitwise 📱 - The Group Tracker: Perfect for trips. It logs expenses and calculates who owes what, so you settle up with one payment instead of a dozen texts. Send a final "Settle up" reminder through the app.

Venmo / Cash App 🔄 - The Social Pay: Great for quick, casual payments. Use the "Request" button—a direct payment request in the app is harder to ignore than a passive text and feels less awkward for everyone.

Zelle 🏦 - The Speed Demon: Built into most banking apps. Send money directly bank-to-bank in minutes with no fees. Perfect for rent and big bills.

The Human Touch Follow-Up

If the app pings don’t work, it’s time for a gentle nudge.The Polite DM: One or two gentle, direct DMs are okay. “Hey, just checking you saw my Venmo request for dinner the other night!”

The In-Person Ask: If you’re hanging out and the vibe is right, a quick, quiet “Hey, whenever you get the chance to send that over, that would be awesome!” works wonders.

Know When to Let It Go

After a couple of attempts, you have a choice: eat the cost to preserve the relationship (and never front them money again), or escalate. Usually, your sanity is worth more than the money.

Special Case: When the Ghoster is Your Bestie (or Your Partner) 💔😭

Even with close relationships, boundaries are key.

Empathy + Firmness: “I know things get busy, but can you please send your share for the electric bill? It’s due tomorrow.”

Automate: Set up recurring Venmo requests or a joint account for shared bills.

The Rule Still Applies: Use the “Refund Safeguard” even here. If flakiness is a pattern, stop fronting large amounts. It’s not personal, it’s practical.

Signing Off

Remember: Structure > guilt. Clarity > assumptions. This “Shared-Cost Code” isn’t about nickel-and-diming your friends over every coffee. It’s about having a clear, respectful playbook for the high-stakes stuff that actually impacts your financial health. Protecting your wallet on a big expense isn’t being cheap—it’s being smart. And knowing when not to pull out the codex is just as important as knowing when you need it. You have the power to make your next group outing seamless and stress-free. Here's to less stress and more fun with your favorite people! 🥂 Mitch — Luci Money Moves Newsletter |  You don’t have to hunt down your friends for your money now! |

🫡 Pssssttt…Your Mission This Week: 🕵️♂️

The next time you’re planning a group trip or a big dinner, be the one who casually suggests the “Refund Safeguard” clause. “Hey, to make splitting easy, let’s just all agree to Venmo the person who pays within 48 hours. Sound good?”

See how easy that was? You’ve just upgraded a friendship and protected your peace. Go you!🍻

Get Rewarded for Playing Bank.Fronting the bill for the group? Make your financial kindness pay you back. Join Luci finds the perfect card to maximize your rewards on shared spending. |  |

Reply