- Luci Money Moves

- Posts

- How to Save Money When You're Broke (But Still Want a Life)

How to Save Money When You're Broke (But Still Want a Life)

Easy ways to save money—even when rent, ramen, and ~bad~ adult decisions drain your wallet.

Listen, we’ve all been there. You open your banking app, and—bam—it hits you like a horror movie plot twist: “Wait, where’d all my money go?!” Suddenly, you’re staring at your $3.76 balance, wondering if ‘vibes’ and ramen qualify as a balanced budget.

But here’s the deal: saving money isn’t just for people who already have fat stacks of cash. It’s for anyone who’s tired of financial anxiety being their default setting. And yes, that includes you, even if your paycheck is doing the vanishing act faster than your battery at 1%.

What We’re Covering

(So You Don’t Get Lost)

🍪 Check This Out

📌 Super Cool Introduction (AKA: "Why You’re Not Too Broke to Save")

💰 Where Is Your Money Really Going? (Spoiler: Probably DoorDash)

💰 Chill Budgeting Tips (Because Spreadsheets Shouldn’t Feel Like Homework)

🛠️ Small Savings That Don’t Feel Like a Punishment (Keep Your Coffee, Ditch the Guilt)

🛠️ Let Luci Do the Legwork (Credit Card Rewards on Autopilot)

🚀 Why Saving a Little Goes a Long Way (Meet Your New BFF: Compound Interest)

🚀 Emergency Fund vs. Big Goals (Spoiler: Do Both, Just in Stages)

✨ Parting Wisdom: Saving Doesn’t Have to Suck—It Just Needs to Start (Future You Says Thanks)

📚New Here❓

Before diving into how to save when you feel broke, check out our two—part “Budgeting 101” series:

Part 1: How to Take Control of Your Money — Learn the basics of budgeting, why it matters, and how to avoid the most common money myths.

Part 2: Tools That Actually Make Budgeting Work — Discover the best budgeting apps, spreadsheet templates, and strategies that don’t suck.

They’re basically the prequels to this article—and way more helpful than any prequel trilogy that shall not be named.

Where Is Your Money Going?

Let’s be honest for a second. Are you “genuinely struggling to make rent,” broke? Or “accidentally spent $200 on DoorDash and oat milk lattes again,” or as I like to call it, “Act rich, get rich” broke?

There’s a difference.

You might not feel like you have money to save, but sometimes it’s hiding in plain sight. Subscriptions you forgot about, $7 iced coffees that “hit different” (but also hit your budget), and those impulsive “I deserve to treat myself” buys add up fast.

🔎 Game time: Open your bank app and scroll through the last week. How many purchases made you whisper, “…yikes😬, that was avoidable”?

Cut costs without suffering—brew your own coffee or keep the lattes, but cancel the “forgotten” gym membership. Let’s be real: you’re basically just paying for a card that lets you claim you’re fit, even though it’s been ages since your last workout.

The Chill Person's Budget Blueprint

If budgeting sounds like a punishment, you’re probably imagining spreadsheets that rival your college thesis. Nah, we don’t do that here.

Try this:

60/20/20 Rule: 60% to needs (rent, groceries), 20% to savings (future you thanks you), 20% to wants (because brunch isn’t technically a need…).

Tighter month? Flip it to 80/10/10. Even saving 10% is better than nothing.

And let’s be clear—fun money should not be 90% of your budget. (Sorry, Local Brunch MVP—your trophy can wait.)

Small Savings That Don’t Feel Like a Punishment

Saving money doesn’t mean turning into a coupon—hoarding hermit. It just means being a bit sneakier about how you do it.

💸 Automate it: Set your bank to move $5 or $10 into your savings right after payday. Out of sight, out of mind—until you check your savings and go, “Wait, I’m kinda killing it?”. This is one of the few things you can ignore after setting up—unlike credit card payments and rent, which demand your attention like a needy ex.

🎁 Windfalls = Wins: Tax refund? Birthday cash from Grandma? Found $20 in your coat pocket? Divert half to savings before the sushi celebration. It’s free money! (Kind of.) Toss it into savings and let Future You enjoy the “Wait, I’m kinda rich?” moment.

☕ Pick your battles: Love your daily coffee or boba? (Boba fans, fight me: it’s just iced tea with textural surprises) Keep it. But maybe cancel that $29.99 subscription to something you haven’t used since 2022. You don’t have to give up everything—just something.

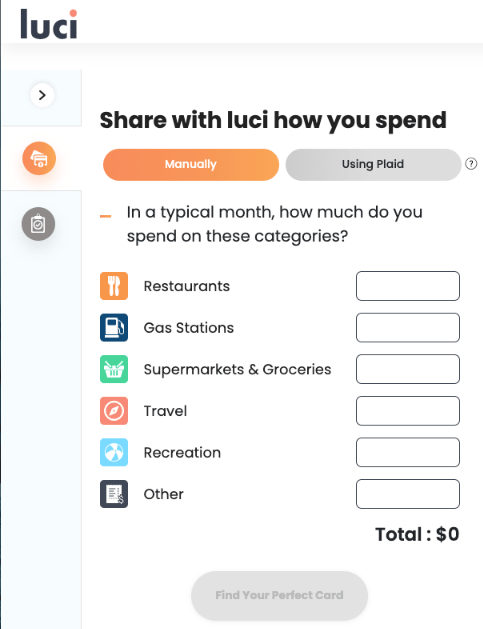

💳 Upgrade your plastic: If you’re going to spend money anyway, at least make it work for you. Switch to a credit card with better rewards–cash back, points, miles, whatever suits your vibe. Then funnel those rewards straight into your savings. 5% cash back on groceries? That’s $5 on every $100 just for existing. Use a card that fits your lifestyle, and let your everyday spending quietly pad your future fund.

💡 Pro tip: Let Luci find your ideal card. Swipe smarter, save faster.💡 Start funneling those rewards from your new credit card today 😎 🧊 |  |

Why Saving Anything Is a Power Move

Even saving $10 a week (roughly 1 FCD, “Fancy Coffee Drink”, RIP) can snowball into thousands thanks to compound interest:

Think of it like this ⤵️

You're not saving just for a rainy day–you’re building a freaking umbrella factory.

And if you’re wondering whether to save or invest, here’s the cheat code:

Emergency fund first,

Invest after (even in micro amounts).

If money is tight, your goal isn’t to become the next Warren Buffett overnight–it’s to stop living on the financial edge and start building a little breathing room.

Emergency Fund vs. Big Goals—Where to Start?

Before you save for that Bali trip or Taylor Swift tickets, you need to cover life’s plot twists.

Start with a mini emergency fund (a “don’t panic” fund) of about $100 to $500. That’s it—just enough for a flat tire or an unexpected doctor visit, not a full meltdown.

Then move on to bite-sized goals. “Save $10,000” feels impossible. “Save $10 today”? Totally doable. Baby steps—by the end of the year, you could have an extra $3,000 to put towards your goals or add to your rainy day fund by just saving $10 a day.

And here’s the long—term vision: eventually, aim to build that emergency fund up to 3—6 months of your essential expenses. Rent, bills, groceries, etc. That’s your financial cushion. Freelancers/startup warriors: Aim for a 12-18 months’ cushion. Because “unpredictable income” shouldn’t mean “constant adrenaline rush”. That way, if life throws a full—on season finale cliffhanger at you, you’re not left scrambling.

Saving Doesn’t Have to Suck—It Just Needs to StartThe biggest mistake you can make is thinking, “I’ll save when I make more.” No, no, no. Saving is a habit, not a salary bracket. Start now. Start tiny. Just start. You can’t learn to ride a bike without, well, getting on and pedaling. Don’t wait around; make it happen! You’re not too broke to save—you’re too smart to keep ignoring your future. And honestly, Future You is gonna be so pumped you did something today, even if it’s just tossing $5 into a jar labeled “Emergency Fund: Break Glass in Case of Zombie Apocalypse (or Rent).” You’ve got this. Ramen phases are temporary. Good money habits? Those stick around. 🍜💪 Get ~adulting~ done, Mitch |  This Could Be You!! |

Reply